Served with a Debt Lawsuit and Don’t Know

What to Do?

You only have days to respond — and if you don’t, they can win by default.

Defend yourself without an attorney using the same documents and strategies used by people who’ve fought back and won.

DEBT DEFENSE RESPONSE

Custom document prep when you’re being sued for a debt.

This service helps you avoid a default judgment from ignoring the lawsuit

Defendant’s Answer (tailored to your state + case)

1 Additional Document (RFP, Motion, or Counterclaim )

Custom document filing instructions

2 Bonus Guides - Litigation Road Map + Demand Proof

Service is per lawsuit

Standard Drafting Service Turnaround 5 business days this is review local court rules for compliance and case research. Rush Service 3 days offered at additional cost of $75.

Starting at $175

Trusted by hundreds of everyday people who fought back — and won.

$289 service does not include case follow up guidance

Frequently Asked Questions

Can I use this in my state?

Yes. The templates are built for general use and adjusted when custom prep (like the DDRK) is ordered. Filing instructions are tailored to your court when needed.

Will someone help me with my case?

No. These tools are for pro se litigants who want to handle their own case. We give you strategy, templates, and walkthroughs — not legal representation. For any guidance you would need to book a consult

Is this legal advice?

No. This is a document prep and educational service for self-represented defendants. It is not legal advice or attorney representation.

How do I get help with next steps after I receive my documents?

Follow-up support isn’t included unless you purchased the bundle option with the Debt Defense Response Kit .

To get help with what to do next, you’ll need to book a consult call.

Do you offer payment plans?

No. All services must be paid in full at the time of purchase.

TESTIMONIALS

REAL LAWSUITS. REAL RESULTS

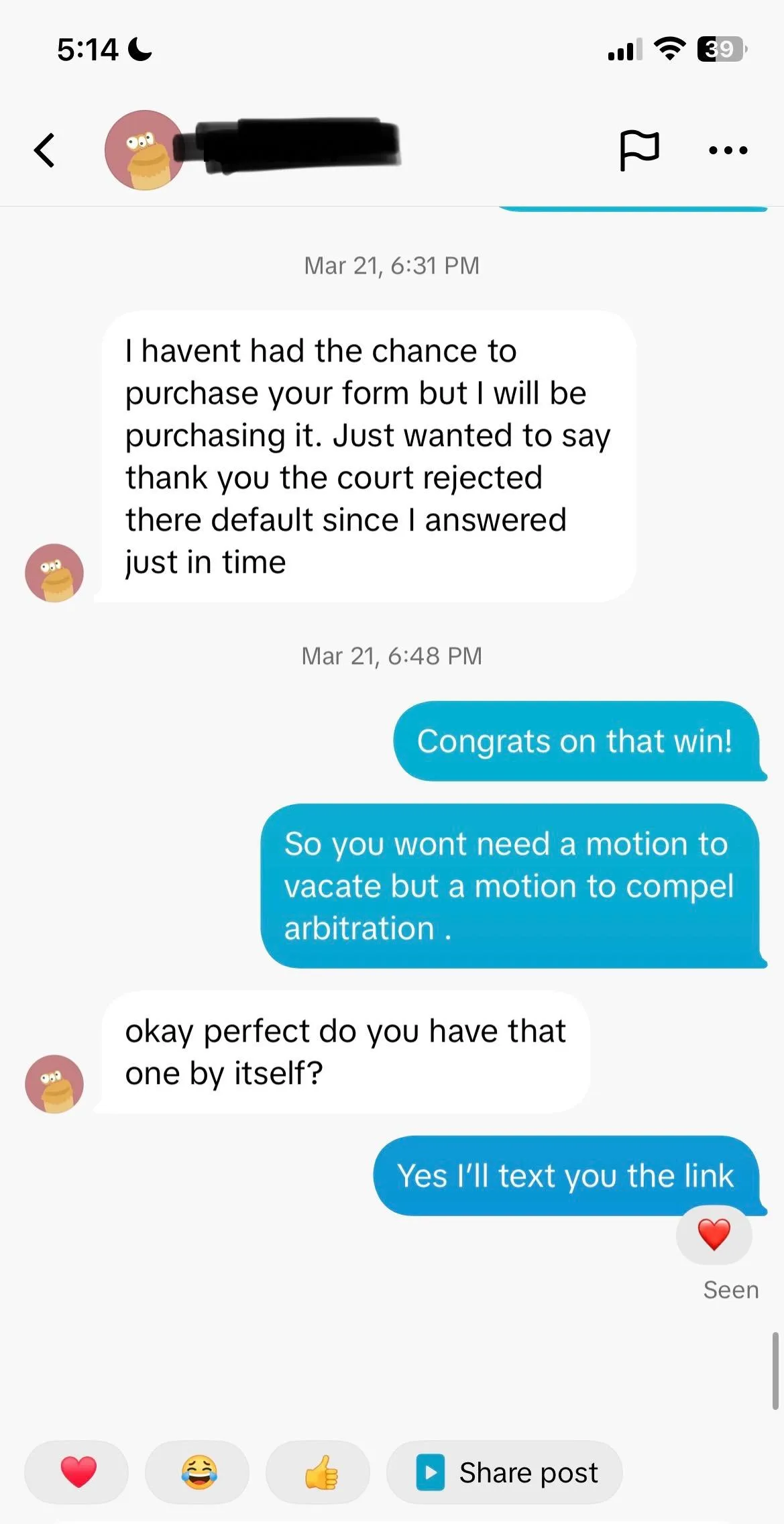

Lisa Purchased The PRO SE Vault Access and used the Answer Template to respond in time to avoid a default judgment being granted

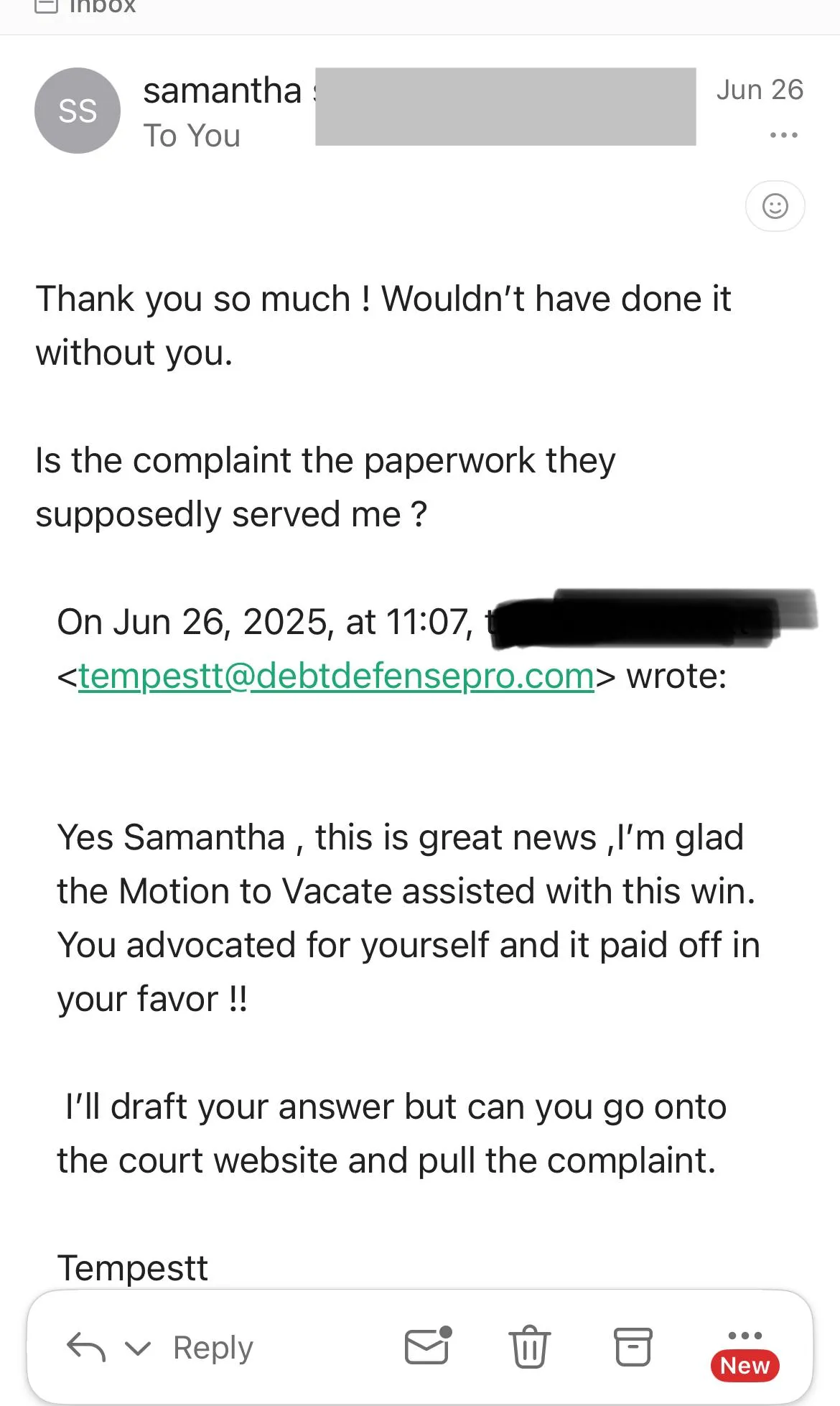

Samantha Purchased the Debt Defense Response Kit to Fight a Default Judgment Against Her

Chris purchased the Debt Defense Response Kit to fight American Express Lawsuit

Refund Policy : ALL SALES ARE FINAL. MEMBERSHIPS MUST BE CANCELED 72 HOURS BEFORE BILLING DATE NO PARTIAL REFUNDS WILL BE ISSUED. ALL PRODUCTS ARE DIGITAL PRODUCTS.

Mailbox Money

Tired of feeling stressed over debt collection letters? Learn how to spot five FDCPA violations, protect your rights, and turn debt threats into opportunities with practical tips you can use right awa... ...more

FDCPA

September 16, 2025•4 min read

How to Negotiate Credit Card Lawsuit Default Judgement Without Filing Bankruptcy

Discover how one debtor used research and strategy to negotiate a $25,000 credit card judgment down to $15,000—without filing bankruptcy. Learn practical lessons for defending debt lawsuits and creati... ...more

Debt Lawsuit Defense

September 09, 2025•4 min read

COMPANY

MEMBERSHIP

CUSTOMER CARE

NEWS

LEGAL

© 2025 Copyright DEBT DEFENSE PRO SE All Rights Reserved.